Developing Dogma

“There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

- Jesse Livermore

The investor has both the privilege and the danger of ruling over their speculative domain with an iron fist. In this sense, you are a new king, tasked with deploying power while also granting liberty to those in your territory. Too much power and you are a tyrant, too much liberty and your ability to use power becomes frail. A king may spend time studying past empires, republics, economics, and law, but in times of war and revolt, the only decisions that will matter will be those made during tumultuous times, involving the emotions of people and how much control you possess over their emotions and yours. Power keeps you king and liberty keeps your people in acceptance of you being their king. This push and pull have both built and collapsed many nations, businesses, relationships and portfolios. Prosperity, and your credit for creating it, slips away once it is seen as something of the past. Things in this world last until they don’t. Centuries of success turn into history at the hands of men who never read it, or worse, think they are above the mistakes of others. The path to longevity is not through prosperity but through a constant study of how prosperity ends and why. A king should thus spend his time both wielding power and standing idle while guarding against all known past fail points. Those of which are internal involving him, his people, and his domain as well as those external such as foreign adversaries and allies. If he does this, success becomes inevitable, at least in his lifetime. It is this great weight of responsibility that the best leaders and investors were able to carry, never allowing it to sway them too far in the direction of greed, fear, power, and liberty. With this view it becomes clear that a deep understand of business, accounting and economics is needed, but must also rest upon a sturdy foundation of lasting principles, for without stringent methodology and the stomach to implement it, one’s understanding will not suffice. In a race of endurance where complex systems like people and markets spin out rare rolls of the dice, what matters is staying power and the way to hold power lies not in understanding the world, but in understanding the people living in the world.

Investing like any high-stake competitive endeavor enhances the best and the worst in people. It is the ultimate freedom of choice (thousands of stocks, bonds, commodities, and currencies to buy and sell) with a heavy binary outcome of riches or ruin. The combination of risk, power, greed and fear entangle to create an ego-boosting, self-loathing cocktail of highs and lows, neither of which can be trusted.

Considering this environment, one must systematize their actions to achieve a result not correlated to the collective nature of the market which preys upon reactionary decision-making. The market has a large appetite for relieving investors from decisions now considered faulty and tempting you into making new decisions that remedy the old. This cycle is what kills novice market participants and at times, seduces the seasoned investor. Because of this, you must set strict rules to follow. Like a person following a diet at an all-you-can-eat-buffet, rules are only worth following when you are tempted to put them on hold. The investor needs rules that are hard to follow; easy rules aren’t actually rules. Mediocre ideas and principles yield mediocrity, which is easy to obtain. You must develop personalized principles that will stand true in hard and volatile times. You must develop dogma.

Dogma is commonly used in a negative connotation to describe a person who blindly follows a set of rules, regardless of circumstance. This is exactly the way to operate a successful investment strategy. You don’t react to anything; you follow trusted rules regardless of how big or small the waves of the ocean curl and crash. Think briefly about Buffett completely ignoring the tech bubble of the late 1990s. Buffett stayed true to principles he knew worked, and ignored what the market was doing. At the time it was not easy watching everyone get rich participating in froth, but Buffett had dogma and he knew what to avoid. Buffett’s dogma rewarded him in the long run and made him grind his teeth in the moment. Those without dogma ground their teeth due to expensive cocaine, and later couldn’t afford a dentist.

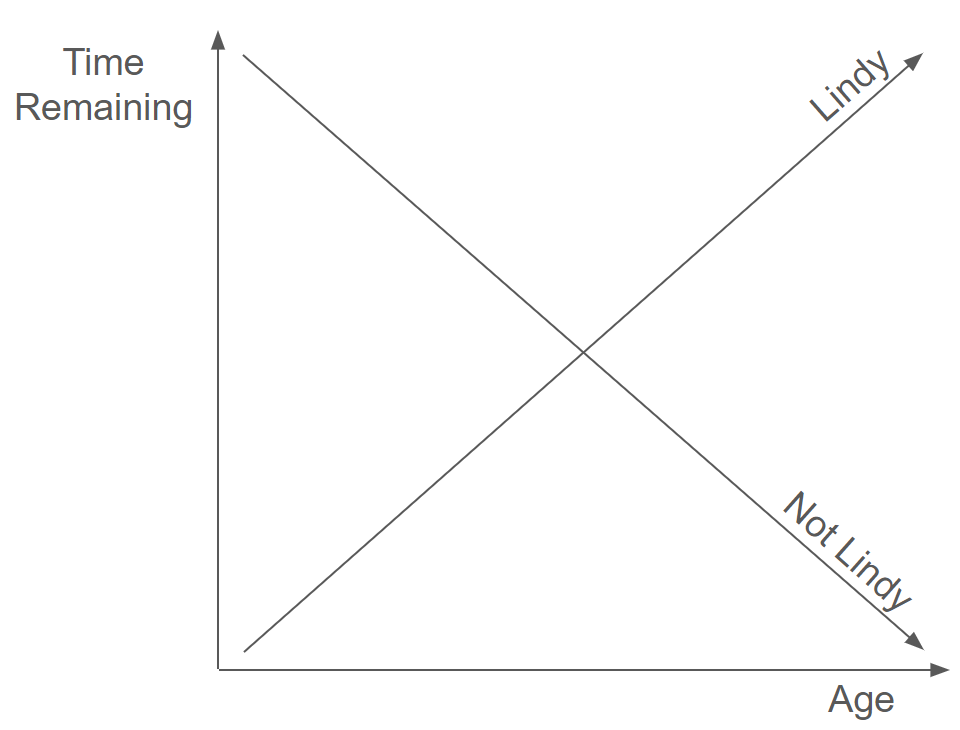

The definition of dogma is “a settled or established opinion, belief or principle.” Whether those principles are derived from history, experience, or a higher power is irrelevant for this essay. What is relevant is ringing the droplets of truth from times past, even if you only get one drop. When developing a set of principles the longer they have lasted, the better. More time means more adversity thrown their way, validating the strength of the foundation they stand upon. This can be applied to anything you look at in the world and has been deemed “The Lindy Effect.” The Lindy Effect was first coined by Albert Goldman and later expounded upon by Benoit Mandelbrot and Nassim Taleb. The Lindy Effect serves to show how robust something is. Humans grow old and die. However, many things grow old, continue to grow older and thus strengthen their position as an enduring part of our world. Things that age in reverse show robust staying power — The Lindy Effect.

Twitter accounts that post motivational content are represented below by the arrow that goes down.

Before we explore the positive we must talk about some quiet tail risks. A dangerous modern phenomenon is thinking that working away from a bad result will push you into the territory of positive results. Although this can sometimes be true, taking action always has risk and should be viewed as such, even if the desired outcome is a possible benefit to society. If you go out and tell the world that the problem you have been put in charge of solving is minuscule or should be ignored, you minimize yourself, your power, your colleagues and your paycheck. This is one of the world’s biggest problems, a fat tail factory. Our modern world always needs progress, usually in the form of a financed solution. We have a current obsession with trying to override our nature entirely. Let’s call these actions with negative consequences “proactive errors.” Proactive errors are the opposite of The Lindy Effect. They start strong and finish weak, like the new shiny toy every kid wants that is later banned for giving children lead poisoning. The fantastic new drug that results in, “if you or a loved one” being played on your television. This topic deserves its own essay, and just might get one.

Investing is seen as a game of wits with hefty rewards for those who are “intelligent” enough to beat the rest. It is true that a lot of money has vanished into thin air at the hands of uneducated and emotional investors, but more money with much more severe effects on the financial system and thus the average man, have vaporized at the mercy of the highly educated and respected investment professionals. Informed atrocities include the 2008 financial crisis where educated bankers running complex models ran the entire financial system so far into the ground, most would be Uber drivers if held accountable for their actions. No disrespect to Uber drivers, I like them more than bankers.

Let’s look at a true beauty — Long Term Capital Management. A firm run by two Nobel Prize winners for economics.

LTCM was a cutting-edge hedge fund utilizing the best in human intellect and technology. The firm completely blew up in 1998 when reality hit not only their financial models, but also their egos. Although this did cause some pain in the financial markets, LTCM was privately owned and in turn, was not bailed out by taxpayers, something I can’t say about the banks.

LTCM, to put it lightly, was not Lindy. Extinction is a hard end, regardless of how well the species did while alive.

Markets are a complex symphony. You can recognize a sound you like, but you are not a musician. You should not be trying to create a process on known information when the known information can change at the drop of a hat, as it does in real life. If you lived for 30 years and decided to model out the next 30 years based on your lived experiences and the next day your house is destroyed, killing your wife and young child, what would you do with your model that was built on data that no longer represents you? This is the sin of finance and economics, a comfort in understanding something that cannot be fully understood — markets. Remember, creating a solution might cause new problems, with more unpredictable solutions needing mitigation.

So, what I am arguing is that developing a framework, an unwavering dogma in the face of uncertainty is the surest way to tackle the vicissitudes of markets, and avoid proactive errors. Now that we have an example of what to avoid and how it masquerades in complex solutions, academic accolades, and short-term adulation, let’s now enter into the world of men whose principles will last longer than their bodies.

LTCM should have listened to Munger…..

“If you think your IQ is 160 but it’s 150, you’re a disaster. It’s much better to have a 130 IQ and think it’s 120.”

- Charlie Munger

Dogma allows something I have come to realize is hugely important — releasing the illusion of control. Any time you think something is happening to you, it is not what is happening that is rotten, but the lens through which you are viewing it that is rotten. Victimization feeds on the vacuum in your mind that is constantly searching for why things happen. The human mind, like nature, abhors a vacuum.

Let’s begin our quest to find lasting principles, principles worth becoming dogma. The investment industry has grown enormously over the last century, so the pool of investment history that precedes that, is unfortunately a bit dry. But, there are a select few to learn from whose principles have lasted long enough to hold water.

What we are looking for is simple — rules that have been proven more correct as time and market cycles pass.

If multiple investors come to similar conclusions that are deemed true with the passing of time, this overlap also holds valuable insights as to how legitimate their claims are.

Furthermore, in trusting these principles and eventually developing your own dogma, you are released of the worthless effort exuded in the search for control in an uncontrollable world and market.

“Systems don’t need to be changed. The trick is for a trader to develop a system with which he is compatible.”

-Ed Seykota

Let us take a look at some of the greatest investors and speculators over the last century and see if we can compile lasting principles you too can assimilate into your own strategy.

Emotional Control

“Individuals who cannot master their emotions are ill-suited to profit from the investment process.

- Benjamin Graham

Having emotional control proceeds having a viable investment process. The latter is quite hard to develop and once developed, completely worthless if not followed methodically and unemotionally.

One of the biggest impediments to proper market conduct is the very reason people enter this game - making money. Detaching yourself from this goal makes it easier to acquire. Forget about making money; focus on developing repeatable actions that have a high probability of being successful over time.

I’ll share a little secret with my readers; I essentially quit investing three years ago. I still had my portfolio, but I gave it about as much attention as I give the news these days. My reasons for doing so were based on the people I met within finance being a bit banal, intellectual lightweights and a jaded feeling towards how intangible the output of the business is. I never wanted to be in corporate America and although investing fascinated me, being in the profession felt like joining the rat race. Regardless, I pretty much wrote it off for a year before coming back. Was I burnt out from the learning curve? Perhaps… I drifted into philosophy, theology and history, leaving the finance books on the shelf. But, what I gained from my break was more valuable than anything I was searching for. I gained a detachment from the market, I gained perspective. After watching my portfolio lose 80% of its value while learning this business, I no longer cared about the fluctuations in my portfolio and realized financial gains and loses were low on my list of things that brought me joy and fulfillment in this world. I don’t advise you to step away from markets, but in a world where we always have a screen in our face, it is very hard to gain perspective without absence. Very few professions pay you to be detached and uninvolved. both from success and defeat. Investing pays double.

“We must remember that delusions swing between extremes, like pendulums. Delusions of grandeur and unending wealth give place to delusions of unending gloom. One is as unreal as the other.”

-Bernard Baruch

In the stock market a good nervous system is even more important than a good head.

-Philip Fisher

Forecasting

“Forecasting is like trying to turn lead into gold.”

-Philip Fisher

I can’t think of a single successful investor who spent an iota of effort forecasting. This is a very black and white topic and should absolutely be part of your investment dogma. Predictions are similar to opinions; it’s best to keep them quiet.

“No one can see ahead three years, let alone five or ten. Competition, new inventions - all kinds of things - can change the situation in twelve months.”

-Thomas Rowe Price

“Markets are never wrong – opinions often are.”

-Jesse Livermore

Cutting Loses

“Not taking the loss, that is what does damage to the pocketbook and to the soul.”

-Jesse Livermore

“Profits always take care of themselves but losses never do.”

-Jesse Livermore

Losses, just like in life, are a part of investing. Your losses can either impact you greatly or minimally. Knowing that you will have losses makes this become a decision regarding how much you will tolerate as opposed to if they will happen.

If you know you will make incorrect decisions, which ensures losses, why let them break you? This question gets more complex for investors with long-term interest in a company who are not swayed by market volatility. But, how can one decipher from market volatility and a business that is slowly sinking? It’s a hard question, but I default to always defending capital. Let’s say you enter an investment three separate times, and get out with three individual losses each totaling 2% of your portfolio’s net worth, you are now down 6%, with the possibility of re-entering one day and riding that position for a 200% gain. Your one win just paid for roughly 33 losses. If that same position ended up being a dud and declined 50%, you are now cutting into your winners and have created a problem that is much harder to look at unbiasedly. It’s easy to follow risk management when you’re down 2%, but that is not the case when you are down 50%. Treat your portfolio like a garden, water the plants and pull out the weeds. There will always be new seeds that yield fresh crops but, if you ignore the weeds, soon you won’t be able to see your garden.

“Rule number one: never lose money. Rule number two: never forget rule number one.”

- Warren Buffett

“An investor should always realize that some mistakes are going to be made.”

-Philip Fisher

“The finest art is not to lose money. Making money in the stock market can be done by anybody.”

-Jesse Livermore

“The essence of investment management is the management of risks, not the management of returns.”

-Benjamin Graham

Time

“The big money is not in the buying or the selling, but in the waiting.”

-Charlie Munger

Time is a huge variable in markets as it’s one of the sole factors that decide your process and returns. Many times the only difference between a decision being right and a decision being wrong, is time. Working your dogma into a timeframe that comports with your actions will create synergies between thought and action. A swing trader would be crazy to let a position develop for a few months, and an investor would be equally crazy to cut off a position after two days of red.

Time is also what pays you. Time and price are the only variables that effect a stock’s performance; that’s it. Information becomes price action and how long you left information effect a position is time. This is one of the reasons selling is so hard; the information you have now might change in both directions. Time is the friend of a quality business and the reaper for fads. My advice: if you have a winner, look for any excuse to hold onto it. If you are holding a loser, don’t let it get out of hand. Re-evaluating and re-entering are always an option. People are impatient; the easiest edge in the market is to be willing to hold longer than others. The market holds less power over you the longer you hold onto it.

“Markets are fundamentally volatile. No way around it. Your problem is not in the math. There is no math to get you out of having to experience uncertainty.”

-Ed Seykota

“After spending many years in Wall Street and after making and losing millions of dollars, I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!”

-Jesse Livermore

“Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn.”

-Jesse Livermore

“The greatest investment reward comes to those who by good luck or good sense find the occasional company that over the years can grow in sales and profits for more than industry as a whole.”

-Philip Fisher

Longevity

People view markets as a place to make money. That simple line is why most people don’t. When you say “make,” you are considering the reward side only. Investing comes down to longevity. Period. Consider a pilot who during a successful career will conduct thousands of flights. One lethal mistake and he takes his life, all those on board, and his reputation with him. The Roman Empire which lasted over 1,000 years is known mostly for not existing anymore. My opening paragraph is essentially a metaphor for how focusing on the productivity side, the reward side, is dangerous when pursuing longevity. Everything eventually succumbs to one error, making past errors look like what they truly are; speed bumps. All the other errors become meaningless, all the victories, meaningless. Tail risk is not risk; it is extinction, unless you are a banker.

The investor must guard against blow-up risk at all costs. This is the number one problem that should concern the investor before anything else. You won’t have any decisions to make if you don’t put longevity before all else. A 50% drop will take your psyche just as long to recover from as your account. Remember, you must guard against your confidence and your process. How do I guard against extinction? I hold cash in the portfolio, dry gunpowder. I don’t use leverage. I act as little as possible to ensure when I do act it is a time of meaningful action. Remember, just as risk is sitting quietly, so is opportunity. 99% of investing is white noise, the other 1% is when you should be extremely active. Like a snake camouflaged and still, when something walks past your nose, act quickly and mercilessly.

“The four most expensive worlds in the English language are “This time its different.”

-John Templeton

“And then at the end of the day, the most important thing is how good are you at risk control. Ninety-percent of any great trader is going to be the risk control.”

-Paul Tudor Jones

“Mankind has always sought to substitute energy for reason, as if running faster will give one a better sense of direction.”

-Bernard Baruch

Not “What” but “Who”

“You can’t make a good deal with a bad person.”

-Warren Buffett

Businesses are a collection of people. Capable and honest management comes before the product the customer receives. This, essentially, is a type of tailwind and nothing can blow wind in your sail or create a storm capable of sinking the ship quite like management. If you have an amazing product, but lackluster management, you will eventually run into serious problems. If you have a decent product and management that can ask the right questions, self-evaluate and attract quality employees, the sky is the limit. This is something I am realize more and more to be deeply important. If you plan to be with a business for more than a few quarters, the main driver of alpha is going to be those behind the flashing ticker.

“If a business is not ethical, it will fail, perhaps not right away but eventually.”

-Sir John Templeton

Tailwinds & Headwinds

“If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But if you try to push the wave out when it’s coming in, it’ll never happen. The market is always right. A trading system is an agreement you make between yourself and the markets.”

-Ed Seykota

Markets are directional. If they aren’t, find ones that are. This is a very simple truth. In order to make a successful investment or trade you have to be aligned with the current trend and understand the main motives behind that trend. This may seem simple, but the human brain has a tendency to pick hard problems in the name of self-flattery. Investors have a proclivity to dissect and unearth hard problems, they think it shows intelligence and thus justifies them to be in a “thinking man’s” profession. Don’t look to swell your ego; look to swell your account, and the way to do that is by looking for an investment where you have something giving you an added push.

“One of the lessons your management has learned - and, unfortunately, sometimes re-learned - is the importance of being in businesses where tailwinds prevail rather than headwinds.”

-Warren Buffett

“After 25 years of buying and supervising a great variety of businesses, Charlie and I have not learned how to solve difficult business problems. What we have learned is to avoid them. To the extent we have been successful, it is because we concentrated on identifying one-foot hurdles that we could step over because we acquired any ability to clear seven-footers.”

-Warren Buffett

Quality Over Everything

As our world becomes more efficient through global competition and technology, this is a principle I believe will become more important as time passes. Investing was once a game centered around discovering what the market was unaware of. Back then, when information was not ubiquitous that methodology worked. Today, the inverse is true. Everyone is flooded with information, like a kid in a candy store, it too is mostly junk. The shift seems to be an emphasis on buying high-quality compounders and doing nothing. You might say, “well, why won’t it go back to value investing?” The world would have to return technology, and I don’t think the Amish are starting an exchange anytime soon. Something else to note, Graham, who is known as the grandfather of value investing, found his biggest winner in buying and holding a high-quality leader know as GEICO. As we will discuss in our next principle, having flexibility and pivoting to what works is a lasting principle as old as life itself.

“It takes the character to sit with all that cash and to do nothing. I didn’t get to where I am by going after mediocre opportunities.”

-Charlie Munger

“Practical investors usually learn their problem is finding enough outstanding investments, rather than choosing among too many.”

-Philip Fisher

“There are fads and styles in the stock market just aster are in women’s clothing.”

-Philip Fisher

Changing One’s Mind

“My approach works not by making valid predictions but by allowing me to correct false ones.”

-George Soros

Similar to taking a loss in the name of longevity, changing your mind requires an ego check with a side of curiosity. I have had success in businesses I first incorrectly wrote off due to a multitude of reasons. If it passes your checklist now, but didn’t a year ago, you would not be following your rules if you didn’t get long. I once purchased a stock, rode it for a 50% gain, got out and repurchased it 50% higher than I sold it. I am still holding onto that position with a +200% unrealized profit. Again, this is a grey area of investing where the answer can only be found through experience. If you change your mind all the time you are a hamster on a wheel. If you are never willing to budge, a sinking statue. You must always consider the possibility you are wrong, because you will be.

“If we become increasingly humble about how little we know, we may be more eager to search.”

-Sir John Templeton

The Only Constant — Man.

“Whatever men attempt, they seem driven to overdo. When hopes are soaring, I always repeat to myself that two and two still make four.”

-Bernard Baruch

On the Lindy scale this is the only principle that truly makes the cut. When using time as a measure of durability, 50 to 130 years is next to nothing. For something to be truly dependable it must be a constant over a long period of time, even if that constant is slippery and unpredictable. Alas, we arrive at the strongest foundation in market speculation; the operating system of humans. This is the most dependable constant in markets and ties back to the quote I opened the essay with. There is nothing new on Wall Street because the actions and reactions of man, especially under pressure, stay relatively constant. You do not need to predict the event; it is much better to understand how man will react to a slew of events. This is not only a more predictable variable, but if done right can consistently be profited from due to the reaction being a more constant variable than the event.

We know about controlling our own emotions but the point I am trying to make is the importance of seeing the market as a collective of investors trying to control their emotions. The truth is, most eventually break and their trying becomes forced action as the dam begins to collapse. Trying your best to be robotic works, but even better is seeing the market as a reflection of you. Read yourself, know others are feeling the same, and try to position yourself on the other side of your emotions and thoughts.

“All through time, people have basically acted and re-acted the same way in the market as a result of: greed, fear, ignorance, and hope”

-Jesse Livermore

“The main purpose of the stock market was to make fools of as many people as possible.”

-Bernard Baruch

“Successful trading is always an emotional battle for the speculator, not an intelligent battle.”

-Jesse Livermore

“The market does not beat them. They beat themselves, because though they have brains they cannot sit tight.”

-Jesse Livermore

Conclusion

“Change is the investor's only certainty.”

-Thomas Rowe Price

The market is as predictable as historical events before they happen. Neither the market nor the event can be predicted, but the main diver of them, human nature can to a degree, be understood.

The way to develop dogma is to see it in others. To take the dogma of the collective — greed, fear, excitement, and misery, and to understand the power lies in its predictability when reacting to events.

Good luck, and remember:

“Happiness comes from spiritual wealth, not material wealth. Happiness comes from giving, not getting.”

-Sir John Templeton